Withholding Tax Rates Japan

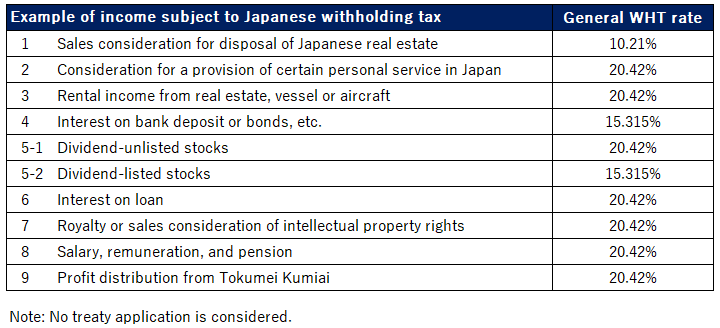

Global tax rates 2017 provides corporate income tax historic corporate income tax and domestic withholding tax rates for more than 170 countries. In some cases withholding tax obligation of the buyer might be exempt under the Japanese tax law.

Step By Step Document For Withholding Tax Configuration Sap Blogs

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Withholding tax rates japan. Japan Highlights 2020 Page 2 of 10 Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million. For the purpose of claiming tax treaty benefits PDF207KB. Recipients Country Alphabetical Order.

Local corporation tax applies at 44 on the corporation tax payable. Companies also must pay local inhabitants tax which varies with the location and size of the firm. Withholding Tax Rates on Dividends and Interest under Japans Tax Treaties The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 18 January 2021.

If the form is not submitted by the deadline the tax is withheld at a rate based on prevailing Japanese laws instead of the tax rate that is prescribed by the Income Tax Convention in Japan. 153 rows Territory WHT rates DivIntRoy Albania Last reviewed 29 June 2021. FAQs for nonresidents invoking withholding tax rates under income tax treaty.

Tax rates for companies with stated capital of more than JPY 100 million are as follows. Spain has signed a new Double Taxation Treaty DTT with Japan that will enter into force on January 1 2022. The non-resident however may apply for a refund of the excess payment by submitting the Application Form for Refund of the Overpaid Withholding Tax.

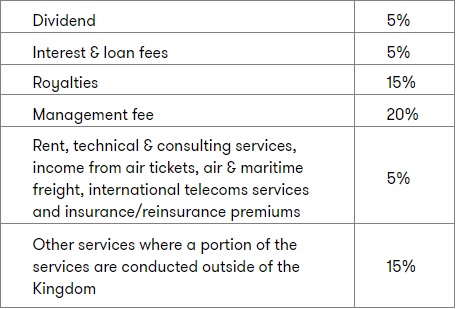

Pensions will be entitled to full exemption 0 withholding. The new withholding rate will be 5 for dividends rather than the previous 15 treaty rate. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Corporate - Withholding taxes. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9. Business tax comprises of regular business tax special local corporate tax and size-based business tax.

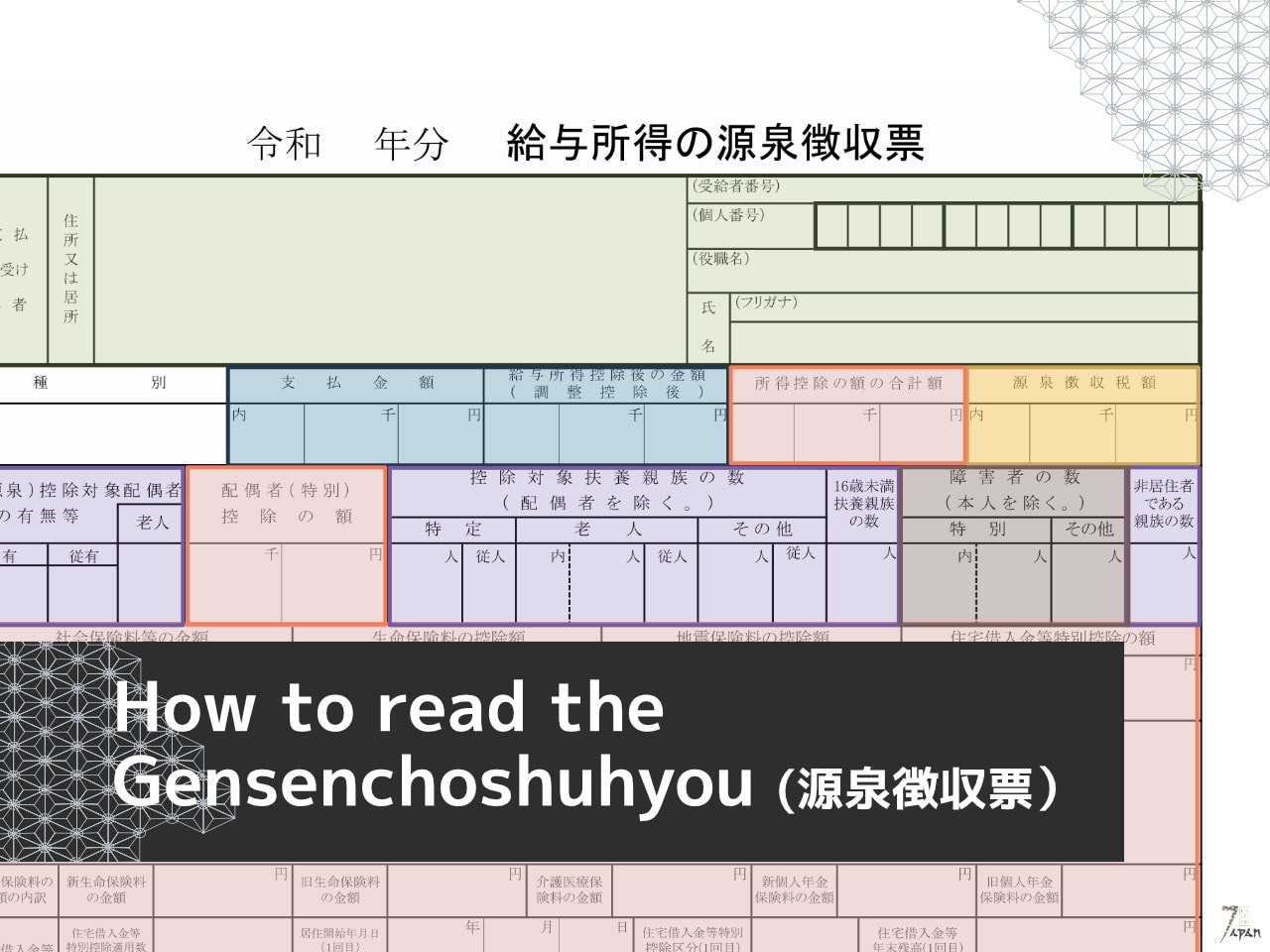

This is an unofficial translation and reference material designed to help you understand the Japanese withholding tax system. With Regard to Non-resident Relatives. Outline of Japans Withholding Tax System Related to Salary The 2020 edition For Those Applying for an Exemption for Dependents etc.

Japans tax agency on 19 May 2021 released a set of frequently asked questions FAQs with information about nonresidents and other eligible persons that submit requests to seek a reduction or exemption from withholding tax pursuant to a provision of an. Last reviewed - 18 June 2021. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain management and technical service fees and similar payments made by a Canadian resident to a non-resident of Canada.

1 Withholding Tax Guide This Withholding Tax Guide is a translation of the 2019 edition of Gensen Choushu no Shikata. Any other royalties are taxed at 125. A non-resident taxpayer whose employment income has not been subject to a 2042 percent withholding tax must file a return by the day of their departure from Japan or by 15 March of the following year if a tax agent is appointed and pay the 2042 percent tax.

Global tax rates 2017 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS. Corporation tax is payable at 234. Where a seller of Japanese real estate is non-resident a buyer has to withhold Japanese income tax from the sales consideration.

Application Form for Income Tax Convention etc. The withholding tax rate is 1021 of sales consideration not a capital gain. Film royalties are taxed at 15.

Application Form for Certificate of Residence in Japan. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law. Thus no liability is accepted.

Corporate - Withholding taxes Last reviewed - 24 June 2021 Under UK domestic law a company may have a duty to withhold tax in relation to the payment of either interest or royalties or other sums paid for the use of a patent. National Income Tax Rates.

Global Corporate And Withholding Tax Rates Tax Deloitte

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Withholding Tax Relief Ppt Download

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

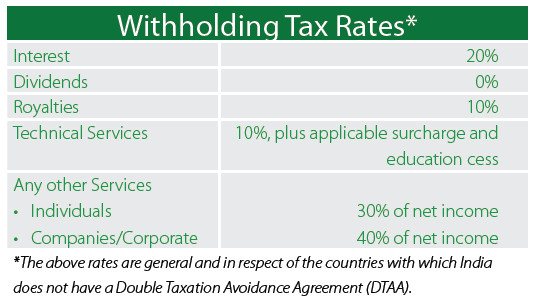

Withholding Tax Rates In India Dezan Shira Associates

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax Treaties Database Global Tax Treaty Information Ibfd

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Gensenchoshuhyou How To Read Japanese Withholding Tax Slip Practical Japan

Corporate Tax In The United States Wikipedia

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Post a Comment for "Withholding Tax Rates Japan"