Employment Tax Liability 1000 Or Less

Subscribe to free payroll insights. Do you expect your employment tax liability to be 1000 or less in a full calendar year January-Decembercheck if yes.

Form 944 is designed for employers with an annual employment tax liability of 1000 or less.

Employment tax liability 1000 or less. An exception may apply to small companies with a total tax liability of 1000 or less for the year. Form 944 generally is due on January 31 of the following year. 6 Employers with annual employment tax liability of 1000 or less report on Form 944 annually and they deposit annually.

If an employers employment tax liability is expected to be 1000 or less and the employer wants to file Form 944 but did not indicate this on the Form SS-4 the employer must contact the IRS to. Have an estimated annual employment tax liability of 1000 or less for the entire calendar year. Where It asks Do you expect your employment tax liability to be 1000 or less in a full calendar year January through December if the answer is yes click yes This means you can file Form 944 just once a year.

For employers in the US. If youre an employer required to file a Form 941 but estimate your tax liability will be 1000 or less for the tax year you may be eligible to switch to Form 944. For most employers you are likely to pay 1000 or less in employment taxes if you expect to pay 4000 or less in total wages in a full calendar year.

To reduce burden for certain small business taxpayers employers who have an Employment Tax liability of 1000 or less for the year will now file Form 944 Employers Annual Federal Tax Return instead of Form 941 Employers Quarterly Federal Tax Return. To request a change send a written request postmarked by March 15 or call the IRS at 800-829-0115 by April 1. Generally if youre an employer in Puerto Rico American Samoa Guam the Commonwealth of the Northern Mariana Islands or the US.

The amount of tax liability you actually have determines your deposit requirements. Based on current tax rates if you pay 5000 or less in wages subject to social security and Medicare taxes and federal income tax withholding during the calendar year youre generally likely to pay 1000 or less in employment taxes. The purpose of Form 944 is to reduce burden on small employers by allowing them to file one return per year and in most cases pay the employment tax.

But if you prefer to file quarterly then click no and you will then file Form 941 four times a year. However if youre a 941 filer and your tax liabilities each quarter are less than 2500 you. Eligible taxpayers will be notified by mail.

Your liability would drop from 5000 to 4000 if youre eligible to claim a 1000 tax credit just as though you had written the IRS a check for that amount. Virgin Islands and you pay 6536 or less in wages subject to social security and Medicare taxes. Possessions you are likely to pay 1000 or less in employment taxes if you pay 6536 or less in wages subject to social security and Medicare taxes.

If you expect to pay 4000 or less in wages you can select Yes YES or NO----I have no Emloyees or will have ---- I would pick yes. Form 941 filers are usually required to make semiweekly or monthly tax deposits for federal income tax and FICA taxes. Employers may be eligible to file Form 944 if their estimated annual employment tax liability is 1000 or less.

Employers whose annual payroll tax liability is 1000 or less can use Form 944 to file only once a year instead of quarterly. Will your business be required to set up payroll and HR compliance within the first 6. Form 944 cannot be used by household employers or agricultural employers.

Even if you file Form 944 your total employment tax liability could potentially exceed 1000. Employers with a tax liability of less than 2500 for the year dont have to make a. Number of OR expected number of Other Employees.

Question on LLC FORM-----Do you expect to have 1000 or less in employment tax liability for the calendar year. While deductions subtract from your income so youre taxed on less credits subtract directly from what you owe the IRS. Only employers whose annual employment tax liability is less than 1000 are eligible to file Form 944 instead of Form 941 Stay in the know.

First date wages werewill be paid. Tax credits reduce your tax liability too but in a somewhat different way. Are not an agricultural employer who is required to file Form 943 Employers Annual Federal Tax Return For Agricultural Employees and are not a household employer who is required to File Form 1040 Schedule H Household Employment Taxes.

Number of OR expected number of Agricultural Employees. In this case the employer would file annually on Form 944 if it receives written consent from the IRS.

Accounting And Bookkeeping Bookkeeping Bookkeeping Software Online Accounting Services

Payroll Tax What It Is How To Calculate It Bench Accounting

What Is Form 941 And How Do I File It Ask Gusto

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Calculation

How Is Tax Collected On Taxable State Benefits Low Incomes Tax Reform Group

3 11 13 Employment Tax Returns Internal Revenue Service

Work From Home By India Tax Starting Your Own Business Tax Working From Home

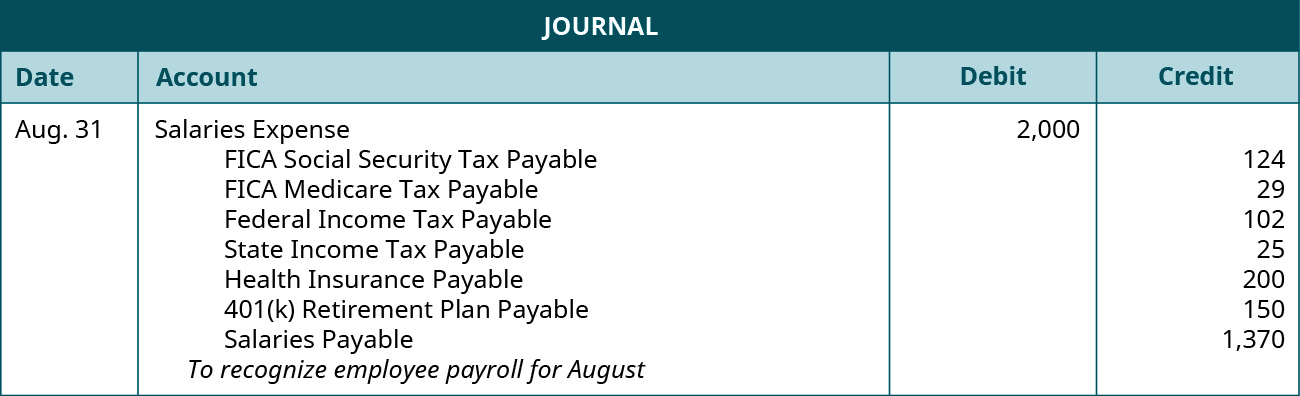

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

What You Need To Know About Income Tax Calculation In Malaysia

14 Tax Tips For The Self Employed Taxact Blog

2020 Instructions For Schedule H 2020 Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

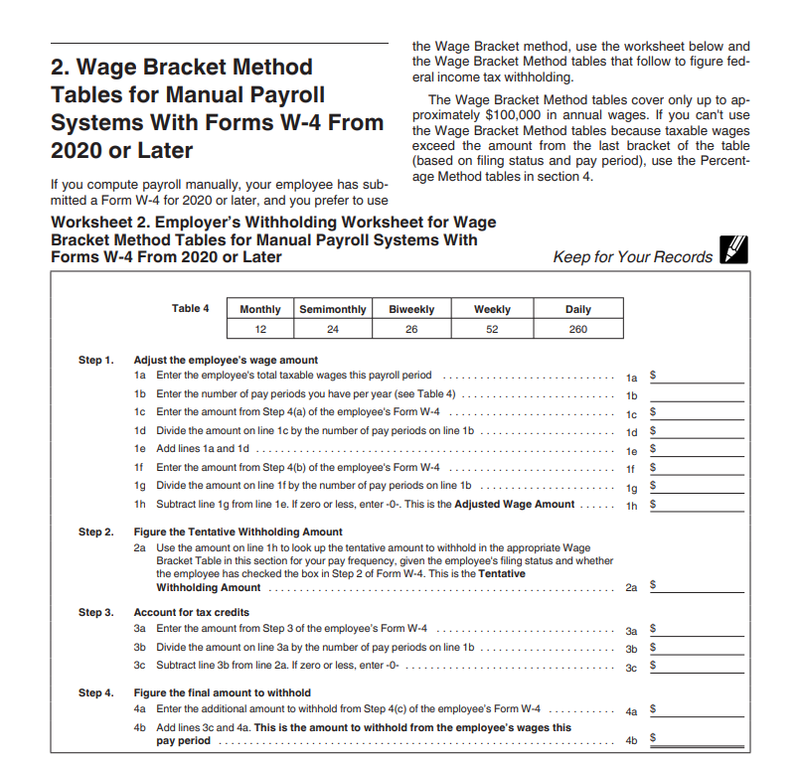

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Calculate Payroll Taxes For Your Small Business The Blueprint

What Is Self Employment Tax 2020 21 Rates Bench Accounting

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Employment Tax Liability 1000 Or Less"