Washington State Employment Tax Forms

Washington Department of Revenue. Demographic and Administrative Forms for New Employees.

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Tax Return Form Example Income

Complete these forms to receive federal tax credits when you hire qualified workers.

Washington state employment tax forms. Once youre signed in you can change your password and access various government services. Your withholding is subject to review by the IRS. You may have created a SAW account to pay your LNI premium or unemployment insurance taxes.

Refund request form Claim for refund EMS 5227 PDF 26KB Request TAX method payment PDF 137 KB Request a tax penalty waiver form online form. ESD sends 1099-G forms for two main types of benefits. It will be made available in a format approved by the Employment Security Department Youll need to show your employer and future employers a letter from the state that says your exemption has been approved to avoid the tax.

By the last date of February send Form W-3 and all original W-2 forms for the preceding calendar year to the Social Security Administration. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. The State of Washington does not have a personal or corporate Income Tax.

Department of Labor and Industries Unemployment Insurance New Hire Reporting Program. Select Request a Tax Penalty Waiver from the dropdown list in the Message box Voluntary election PDF 37 KB Work Opportunity Tax Credit prescreen form 8850 PDF 248KB Work Opportunity Tax Credit form ETA 9061 PDF 95KB. Copy machines cannot reproduce the ink so when someone submits a copy of the form the information must be hand-keyed into the system.

Send an email to OlympiaAMCesdwagov or call 855-TAX-WAGE option 4 for paper. Tax reports or tax and wage reports are due quarterly. To protect against the possibility of others accessing your confidential information do not complete these forms.

Small Business Administration - Washington State Agencies Boards and Commissions Washington County Websites Doing Business with Washington State Government Revised Code of Washington. If you have employees working in Washington you likely must pay unemployment taxes on their wages in this state. The state of Washington does not impose a personal income tax.

Form 1120-S and 1120 K-1 forms for each owner plus withholding from each owners paycheck for income taxes Social Security and Medicare Businesses using a calendar year must file by March 15. To request our paper forms. No income tax in Washington State.

Working for Washington state is work that matters. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. We encourage workers to compare the state programs lifetime benefit.

The 1099-G is a tax form for Certain Government Payments. To receive federal income tax forms please visit the Internal Revenue Service IRS website. Give Form W-4 to your employer.

Form Number if applicable Form. Schedule H Form 1040 or 1040-SR Household Employment Taxes Form 4137 Social Security and Medicare Tax on Unreported Tip Income Form 8919 Uncollected Social Security and Medicare Tax on. For federal income tax forms visit the Internal Revenue Service IRS.

Washington state does not have a personal income tax and the business is not required to provide copies of the W-2s for income tax purposes. Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid. Whether its helping a vulnerable child making highways safer or restoring salmon habitat the work that we do matters to the people of Washington State.

SecureAccess Washington allows Internet access to multiple government services using a single username and password. December 2020 Department of the Treasury Internal Revenue Service. IRS Form 8850 Certification Workload and Characteristics of Certified Individuals form.

ESD and LI recommend that employees follow-up with their employer to ensure that the business has registered for. Unemployment and family leave. The states website about the program called the WA Cares Fund is here.

If you file using a taxwage form that is not an Agency original form you may have to pay a penalty. ETA Form 9061 Conditional Certification form. Businesses using a fiscal year must file by the 15th of the third month after the end of a fiscal year.

Starting January 1 2022 all Washington employee wages those employees who work in Washington receive wages reported on a Form W-2 and work at least 500 hours per year are subject to a 058 premium assessment for example 058 premium assessment on. ETA Form 9058 Individual Characteristics form. Complete Form W-3 Transmittal of Wage and Tax Statements which summarizes all W-2 Forms issued by the employer.

Forms Filed with the Appropriate Income Tax Return Related to Employment Taxes. ETA Form 9062.

An Annoyed Taxpayer Recently Fumed That Her Check To The Internal Revenue Service Took 16 Days To Travel Fewer Than 25 Mile Payroll Taxes Tax Capital Gains Tax

How To Form An Llc In Washington State Free Guide Llc University In 2020 Llc Taxes Small Business Tax Business Bank Account

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

State W 4 Form Detailed Withholding Forms By State Chart

State W 4 Form Detailed Withholding Forms By State Chart

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2021

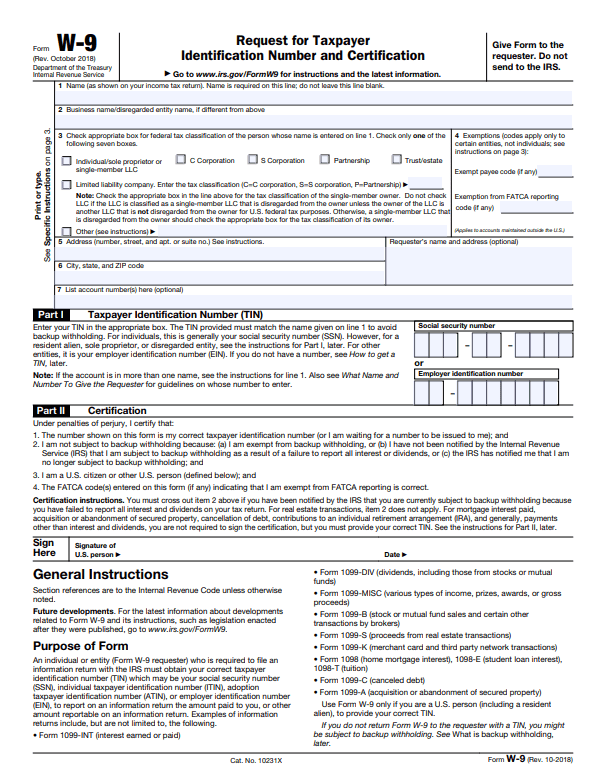

W 9 Request For Taxpayer Identification Number And Certification Pdf Irs Forms Tax Forms Blank Form

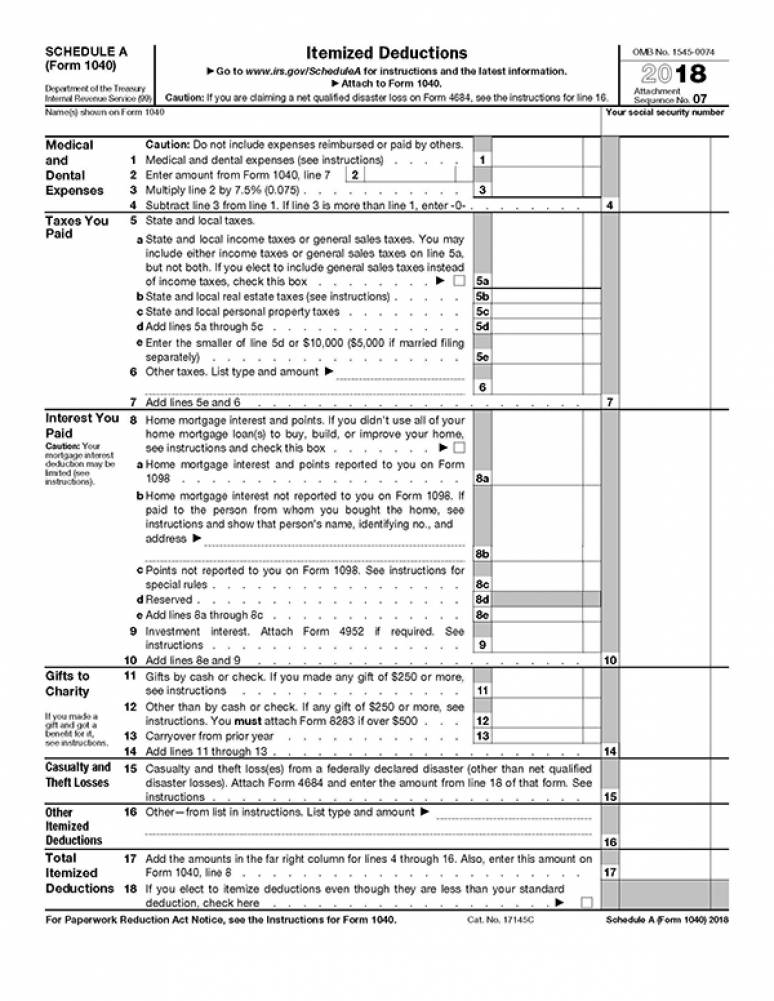

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

How To Read And Understand Your Form W 2 At Tax Time W2 Forms Irs Tax Forms Tax Forms

What Is Irs Form W 9 Turbotax Tax Tips Videos

W2 Forms Copy B Employee Federal Discount Tax Forms

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service Fillable Forms

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Flag Coloring Pages State Tax Tax Forms

Free Sample Example Format Download Free Premium Templates Employment Application Job Application Form Online Job Applications

Post a Comment for "Washington State Employment Tax Forms"