Unemployment Tax Refund Louisiana

The 10200 is the amount of income exclusion for single filers not the amount of the refund. William Gittins WillGitt Update.

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

A typical refund amount will be far smaller than 10200.

Unemployment tax refund louisiana. Louisiana Revised Statutes of 1950 Title 23 Chapter 11 covers the law and administration thereof. According to the Louisiana. The amount of the refund will vary per person depending on overall income tax.

To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year. Our law must also conform to the Federal Social Security Act and FUTA requirements. 2021 PDF 2020 PDF 2019 PDF Employer UI tax rate notices are available online for the following rate years.

Some 13 million taxpayers who received jobless benefits last year and paid taxes on the money are eligible though not everyone will receive a refund depending on past-due debt. Refunds will be calculated using the maximum allowance. This law must be approved by the U.

State Income Tax Range. So far the IRS has identified 13 million taxpayers that may be eligible for. However since then I have forgotten how to view it and dont know if it was a one time viewing or something else.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or 10200 for all other. I did not have paid leave or unemployment. Louisiana Unemployment Insurance Tax Rates.

Louisiana taxes unemployment benefits to the same extent as they are taxed under federal law. Unemployment benefits are subject to federal income taxes and must be reported on your income tax return. Secretary of Labor for Louisiana employers to be able to receive credits against the Federal Unemployment Tax Act FUTA.

THE IRS is sending out more 10200 refunds to Americans who have filed unemployment taxes earlier this year. If you didnt have an overpayment on your 2016 Louisiana return you will need to contact the Louisiana Department of Revenue. Those who are due to receive the refund are taxpayers who filed for unemployment in 2020 but submitted their tax returns.

Unemployment tax refund amount Several months ago I was able to log into my TurboTax account and view the updated tax refund coming from the CARES Act. The 10200 tax-free allowance was only introduced in March and the provision only applies to unemployment benefits received during the 2020 tax. If you choose you can have federal income taxes withheld from your unemployment benefit check.

Americans who collected unemployment benefits in 2020 during the COVID-19 pandemic but filed their taxes before Congress voted to make much of that money tax. The first 50000 received from an employer as severance pay unemployment compensation and the like as a result of administrative downsizing is also not taxed. Any taxpayer who received these funds but has filed their 2020 state income tax return already can submit an amended return to reduce their taxable income.

Why do I need to If you received a Form 1099-G it will be reported to the IRS. The first 10200 of unemployment benefits paid to Louisiana residents who received them in 2020 are not subject to Louisiana state income tax. The IRS is in the process of sending out tax refunds for unemployment benefits recipients who mistakenly paid tax on jobless support claimed in 2020.

The first 10200 of unemployment benefits paid to Louisiana residents who received them in 2020 are exempt from Louisiana state income tax. In states that dont offer the unemployment tax break taxpayers must add back any benefits excluded on their federal tax return when filing their state taxes. The 2021 wage base is 7700.

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Form Ci 9 Download Printable Pdf Or Fill Online Unemployment Benefits Rights And Responsibilities Benefits Rights Information Louisiana Templateroller

Portion Of 2020 Unemployment Benefits Exempt From Louisiana State Income Tax

When Will Irs Send Unemployment Tax Refunds Wfaa Com

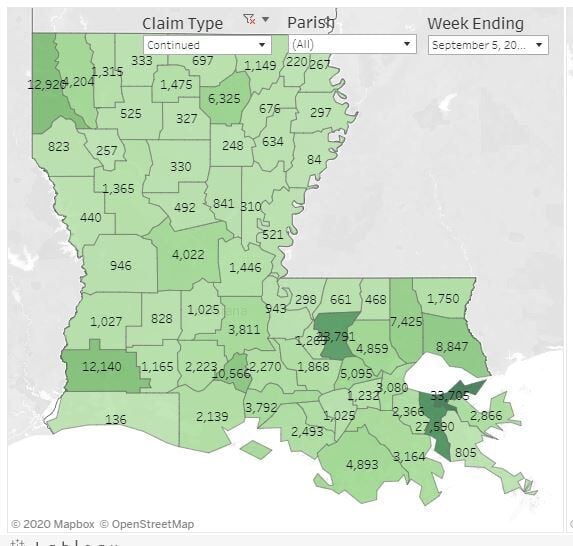

Thousands Of Louisiana S Unemployed Were Sent Overpaid Benefits Notices In Error Lwc Apologizes Coronavirus Theadvocate Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

When To Expect Unemployment Tax Break Refund Who Will Get It First As Com

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Https Revenue Louisiana Gov Taxforms 65000 4 21 F Pdf

3 12 154 Unemployment Tax Returns Internal Revenue Service

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Beneficiaries May Get Second Refund

Applications For Disaster Unemployment Assistance Being Accepted In Louisiana

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

How Many People Are Getting An Unemployment Tax Break Refund As Com

Reporting Your Unemployment Benefits On Your 2020 Tax Return Slls

Irs Louisiana Oklahoma Texas Federal Income Taxes Due Tuesday Arklatexhomepage

Post a Comment for "Unemployment Tax Refund Louisiana"