New Jersey Employer Tax Rates

If youre a new employer youll pay a flat rate of 268. Beginning January 1 2020 there will be a significant adjustment in the taxable wage base for New Jersey employees to accommodate benefit increases that will take effect on July 1 2020.

2021 New Jersey Payroll Tax Rates Abacus Payroll

Employing staff and your tax obligations.

New jersey employer tax rates. Electronic Filing Mandate for Employer Year-End Filings and Statements. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is. New Jersey Temporary Disability TDI Family Leave Insurance FLI Taxes The 2020 TDI and FLI Taxable Wage base for employees-only is 134900 a significant increase from 2019s 34400 due to.

The employee taxable wage base for TDI and FLI will increase from 34400 to 134900. New Jersey new employer rate includes. The TDI rate will increase from 017 to 026 for 2020.

Tax rate of 175 on taxable income between 20001 and 35000. Register as an employer. The wage base increases to 34400 for 2019.

The 2021 taxable wage base in New Jersey for TDI and FLI workers only is 138200 up 3300 from the taxable wage base amount of 134900 in 2020 DOL Communication. The new employer rate continues to be 28 for fiscal year 2020. Upload your employees effective rates for employer returns.

These rates include the 01 Workforce Development Fund rate and the 00175 Supplemental Workforce Fund rate. New Jersey employer UI tax rates continue to be assigned on Rate Schedule B for fiscal year 2021 July 1 2020 through June 30 2021 ranging from 04 to 54. In New Jersey unemployment taxes are a team effort.

Withholding Requirement for Construction Contractor Services. Tax rate of 14 on the first 20000 of taxable income. The new employer rate continues to be 28 for fiscal year 2021.

NJ-WT New Jersey Income Tax Withholding Instructions. 2020 Income Tax Rate and Withholding Instruction for Income Between 1 Million and 5 Million. 03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2019.

If the employee works only part of the time out of state or the other states withholding tax rate is lower than New Jerseys you must withhold New Jersey taxes in addition to the other state to offset the employees resident income tax liability. Commuter Transportation Benefit Limits. Both employers and employees contribute.

Unemployment Insurance UI. New Jersey new employer rate includes. 03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2021.

For single taxpayers living and working in the state of New Jersey. New Jersey Gross Income Tax. Rates range from 04-54 on the first 36200 for 2021.

EY Payroll Newsflash Vol. Help with online employer returns for tax social security and manpower. For complete details on 2021 withholding tax rates read the Employer Guide to 2021 Tax Withholding Changes online here.

The Garden State has a progressive income tax system. The 2021 taxable wage base in New Jersey for UI WFSWF and TDI employers will be 36200 up 900 from the taxable wage base amount of 35300 for 2020. Withholding Rate Tables Effective January 1 2019 Notice.

The rates which vary depending on income level and filing status range from 140 to 1075. 12 rnduri Click to read more on New Jerseys minimum wage increase. New Jersey fiscal year 2020 SUI rates remained on the same table as FY 2019 As we previously reported employer SUI tax rates continue to range from 04 to 54 on Rate Schedule B for FY 2020 July 1 2019 through June 30 2020.

The top tax rate in New Jersey is one of the highest in the US. Withholding Rates and Tables. PANJ Reciprocal Income Tax Agreement.

Tax rate of 35 on taxable income between 35001 and 40000. Outside of payroll taxes legislation signed into law in 2020 also reinstated the 25 corporate business tax surcharge that originally had been scheduled to be reduced to 15 for the 2020 tax year. Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30.

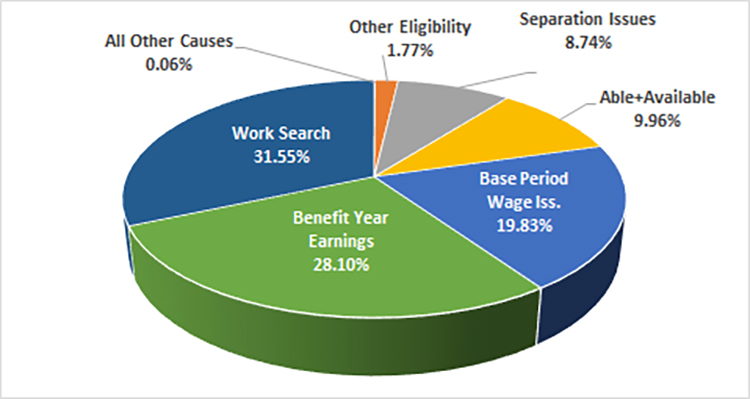

Employer Requirement to Notify Employees of Earned Income Tax Credit. 11 rnduri New Jersey Unemployment Tax.

A Comparison Of The Tax Burden On Labor In The Oecd 2018 Key Findings Average Wage Earners In The United States Legal Marketing Payroll Taxes Local Marketing

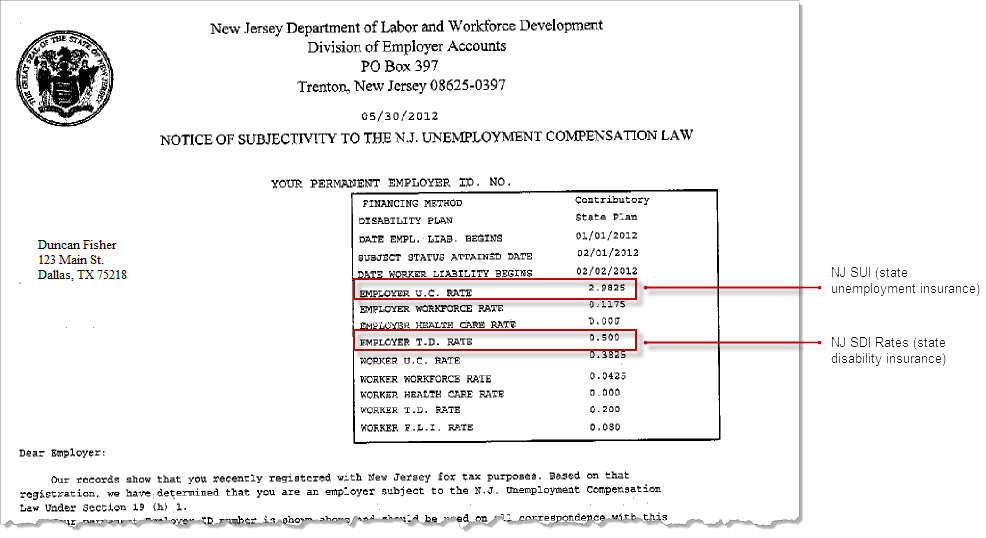

Division Of Employer Accounts How And When To Register As An Employer

Nj 1040 Fill Online Printable Fillable Blank Pdffiller

Aatrix Nj Wage And Tax Formats

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

Https Www Njd Uscourts Gov Sites Njd Files Nj W4 1 Pdf

Services Provided By New Jersey Payroll Services Llc Good Essay Resume Template Free Sample Resume

New Jersey Nj Tax Rate H R Block

2020 New Jersey Payroll Tax Rates Abacus Payroll

Nj Llc How To Start An Llc In New Jersey Truic

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Business Tax Legal Marketing Tax Lawyer

New Jersey U S Department Of Labor

Pin By Joy Desmarais Lanz On Hr Payroll Employment Tax

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Nj Minimum Wage Updates For 2021 Abacus Payroll

Nj Familycare Income Eligibility And Cost

Post a Comment for "New Jersey Employer Tax Rates"