Employment Tax Rates Iowa

However if the supplemental wage payment is included with the regular wage payment the two are combined and the withholding tables or formulas are used. Iowa Workforce DevelopmentUnemployment Tax Rate Table Remains the Same for 2020 September 18 2019.

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Form IA-1040X - Individual Income Tax Return.

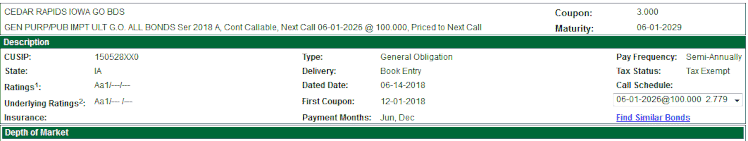

Employment tax rates iowa. If any part of the federal tax payments on lines 31 32 or 33 include federal household employment taxes then the federal household employment taxes must be added back on line 28. This an employer-only tax. Approximate Cumulative Taxable Payroll Limit.

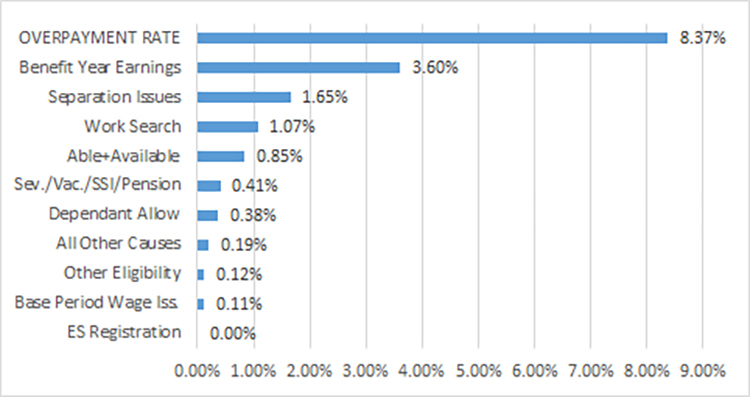

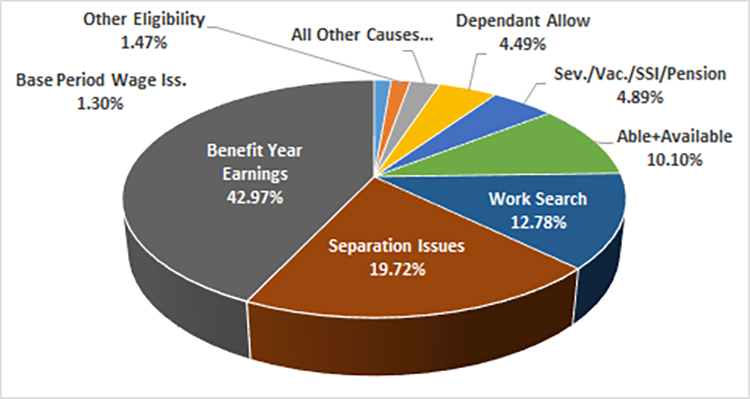

Applying the Rate Table to the Rankings your Notice of Tax Rate is sent in November of each year for the following tax year employers whose benefit ratios place them in Rank 1 are assigned the corresponding Rank 1 rate from the rate table. Tax rates vary in the United States. If federal income tax is withheld on a flat rate basis Iowa income tax is required to be withheld at the rate of 6 percent.

Penalty and Interest Rates Iowa Department of Revenue. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Iowa for single filers and couples filing jointly. 1 2020 unemployment tax rates for experienced employers are to be determined with Table 7 and range from zero to 75 unchanged from 2019.

By comparing the states you can get an idea of what youd be paying if you moved somewhere new. EMPLOYMENT SECURITY - UNEMPLOYMENT C OMPENSATION 967. If you dont have your tax withholding with an employer you may be responsible for submitting your tax quarterly.

Use the estimated tax coupons in form IA-1040ES to submit your quarterly payments. The rate ranges from 033 on the low end to 853 on the high end. Contribution Rate Tables 1.

Currently approximately 44 percent of Iowas ranked employers have a 0000 percent rate. The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks. Effective for 2021 unchanged from 2020 total tax rates for experience-rated employers will range from 000 to 750.

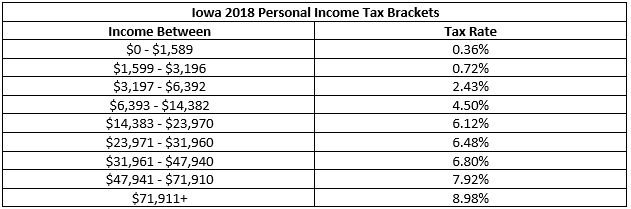

Tax rates are to range from zero to 75 Iowas unemployment tax rates are to be unchanged for 2020 the state Department of Workforce Development said Sept. Iowa State Unemployment Insurance SUI. Iowa charges a progressive income tax broken down into nine tax brackets.

It is acceptable to report on line 28 either the current years self-employmenthousehold employment tax. Rates vary from 0000 to 9000 on table 1 and from 0000 to 7000 on table 8. 18 on its website.

Employers with previous employees may be subject to a different rate. Use our database to learn about tax rates. Iowa does not have any local city taxes so all of your employees will pay only the state income tax.

713 Zeilen Iowa These occupational employment and wage estimates are calculated. State Unemployment Tax Rate. Tax rate of 067 on taxable income between 1667 and 3332.

328 Zeilen Earners in Iowas bottom tax bracket pay a rate of just 033. Federal household employment taxes are not allowed as a deduction for federal taxes on the Iowa return. Iowa workforce information in the form of a newsletter.

Tax rate of 225 on taxable income between 3333 and 6664. Reference 701 4623 Iowa Administrative Code. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 are set by the IRS.

All household employers in Iowa are required to have a workers compensation policy for any employee. Tax rate of 033 on the first 1666 of taxable income. Iowa has nine marginal tax brackets ranging from 033 the lowest Iowa tax bracket to 853 the highest Iowa tax bracket.

Sources from the Iowa Workforce Development Department indicate that unemployment tax rates for 2021 will remain unchanged. This version of IA-1040 is a PDF form that can be. In Iowa the new employer SUI state unemployment insurance rate is 10 percent on the first 32400 of wages for each employee.

IA-1040 is the long-version Iowa 1040 income tax return for use by all in-state residents. For single taxpayers living and working in the state of Iowa. Find the Tax Rates near you.

Where S My Iowa State Tax Refund Ia Tax Brackets Taxact Blog

The Implications Of The Tjca S Large Increase In The Estate And Gift Tax Exemption Are Complex And Affect Estate Estate Planning Income Tax Federal Income Tax

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Colin Gordon The Decline Of Job Based Health Insurance In Iowa 2002 12 Health Insurance Job Finance

Ag Payroll Iowa State Extension Iowa Payroll Iowa State

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Anti Suffrage Ad 1916 Anti Suffrage Suffrage Iowa

Https Tax Iowa Gov Sites Default Files 2020 11 Ia 20withholding 20formula 20and 20instructions 20ty2021 Pdf

Minimum Wage In Iowa Iowa Minimum Wage 2021

Colin Gordon National Jobs In Recession And Recovery Chart Job Employment

Iowa Sales Tax Small Business Guide Truic

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Post a Comment for "Employment Tax Rates Iowa"