Employment Tax Liabilities Definition

The employer withholds those taxes that are paid by employees and remits them to the applicable government authorities along with the taxes that are paid by the company. Certificate - Adjusting Entries.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Calculation

A payroll liability can include wages an employee earned but has not yet received taxes withheld from employees and other payroll-related costs.

Employment tax liabilities definition. Topics within these pages range from obtaining workers compensation insurance to fulfilling employer obligations for state. Certificate - Debits and Credits. Certificate - Income Statement.

Certificate - Cash Flow Statement. Certificate - Financial Statements. This subsection will also discuss the income tax on self-employment income item f.

Employers liability insurance is an insurance policy that handles claims from workers who have suffered a job-related injury or illness not covered by workers compensation. Self-employment tax essentially covers both the employer and employee portions of Social Security and Medicare taxes. As a small business owner you have a self-employment tax liability unless your business is incorporated.

Certificate - Balance Sheet. Tax liabilities accrue when you earn income or another kind of taxable event occurs like issuing payroll or selling off your stock holdings for a profit. A deferred tax liability is a tax that is assessed or is due for the current period but has not yet been paidmeaning that it will eventually come due.

Your tax liability isnt based on your overall earnings but on your taxable income after you take deductions and claim tax credits. Employee compensation taxes and voluntary deductions all generate payroll liabilities. A tax liability is a tax debt you owe to a taxing authorityaka the IRS state government or local government.

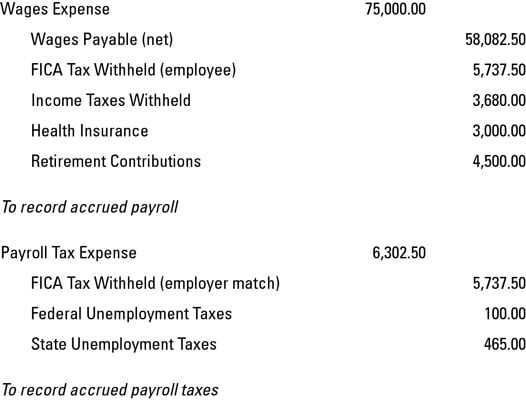

Certificate - Bank Reconciliation. In addition employers incur payroll liabilities for FICA Federal Insurance Contribution Act tax and other expenses. One-half of Medicare taxes.

A determination of employment tax liabilities requires finding that there is an employer an employee and a payment of wages or compensation. Sample 1 Sample 2 Sample 3. Learn the requirements which come with being an employer in Massachusetts.

Employment Related Liabilities means all Liabilities including litigation costs which relate to an Employee a Terminated Employee or their respective dependents and beneficiaries in each case relating to arising out of or resulting from employment by the Existing U S WEST Group or predecessor prior to the Separation Time including Liabilities under Employee Benefit Plans and Employee. The Internal Revenue Service uses the term employment taxes to refer to a list of taxes that relate to employees including IRS federal income taxes withheld from employee pay and paid to the IRS on the employees behalf. In most cases employers withhold portions of wages in order to cover an individuals liabilities.

The liability contains taxes that are paid by employees and taxes that are paid by the employer. Your total tax liability is the total amount of tax you owe from liabilities like income tax capital gains tax self-employment tax and any penalties or interest. Employers Liability for Employment Taxes.

Your self-employment tax liability is 153 of your net earnings. One-half of social security taxes. In addition to federal income taxes and social security and Medicare taxes withheld from an employees pay there are employment-related taxes that the employer is responsible for.

An employer is any person corporation or organization for whom an individual performs a service as an employee. An employer discharges an employees debt when he or she pays a bill for goods or services direct which in law is the. Certificate - Financial Ratios.

Certificate - Working Capital. Employment Taxes means those Liabilities as defined in the Separation and Distribution Agreement for Taxes which are allocable pursuant to the provisions of the Employee Matters Agreement. Essentially if youre paying taxes on it its a tax liability.

An employer is liable for. Employer Tax Obligations. Payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid.

Your regular wage earnings for a job also create a tax liability. Your current years tax liability appears on line 37 of the 2020 Form 1040. It will be taxable as earnings if it comes from the employment see EIM00600.

The deferral comes from the difference in. Federal employment taxes consist of five separate employment taxes items a through e. A tax liability is what you owe to the IRS or other taxing authority when you finish preparing your tax return.

Tax Liability What Is A Tax Liability And What You Should Know

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

What Are Employee And Employer Payroll Taxes Ask Gusto

Accounting Principles Ii Payroll Liabilities Accounting Principles

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)

Deferred Tax Liability Definition Examples

Your Bullsh T Free Guide To Taxes In Germany

What Is Tax Liability Explained Abc Of Money

What Is A Deferred Tax Liability Community Tax

What Are Payroll Liabilities Definition How To Track Them More

How To Record Accrued Payroll And Taxes Dummies

Your Bullsh T Free Guide To Taxes In Germany

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Calculation

Accounting Principles Ii Payroll Liabilities Accounting Principles

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Calculation

How To Calculate Hypotax Eca International

Balance Sheet Liabilities Current Liabilities Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

Post a Comment for "Employment Tax Liabilities Definition"