Employment Tax Statement Germany

Germany has a progressive tax rate currently ranging from 14 to 42. In addition Germany levies a solidarity surcharge amounting to 55 of the income tax liability and.

Tax Class In Germany Explained Easy 2021 Expat Guide

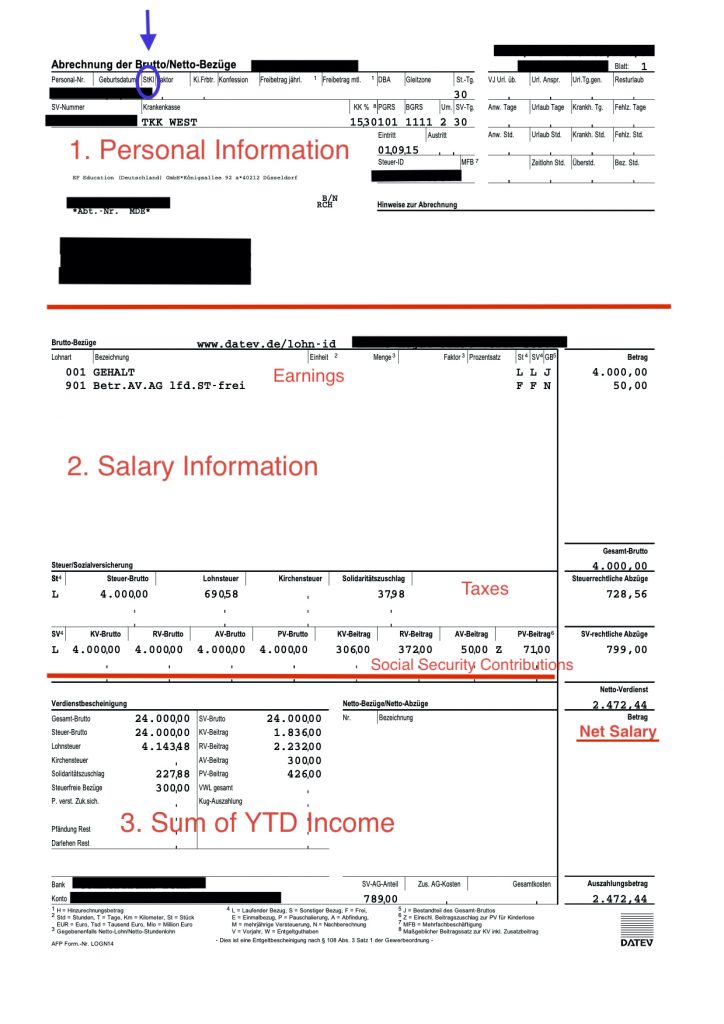

Here Income tax Lohnsteuer is automatically deducted from your salary and further transferred to tax office Finanzamt.

Employment tax statement germany. Income tax is deducted from the money you earn over the year ie. The tax year runs from 1 January to 31 December in Germany. The church tax rate is dependent on which state the employee lives in.

At the end of a calendar year an annual tax return must be submitted to the tax office. Here are the most commons forms for tax return in Germany If you are an employee you need the following forms eg for 2020. When Are Taxes Payable in Germany.

If the income from employment is subject to wage tax withholding the tax obligations are fulfilled with the withholdings and in many cases no German tax return needs to be filed or cant even be filed at all exceptions exist for EU nationals. The income tax Einkommensteuer. Based on this projected figure the tax office will work out a preliminary tax bill.

ESt 1 V 2020 The main form that details general info like your adress iD nummeretc Anlage N 2020 The form to detail your income as an employee. You receive welfare benefit payments. You can usually use the simplified tax return for employees Vereinfachte Einkoimmensteuererklrung fr Arbeitnehmer - Mantelbogen ESt 1V if any of the following apply to you.

In 2021 this basic tax allowance is 9744 euros if you are unmarried and not in a civil partnership. Statement of freelance income or commercial income. Employers should be aware that whilst an employees personal data can be collected for employment related purposes the information sought and in particular methods used for background checks are very limited.

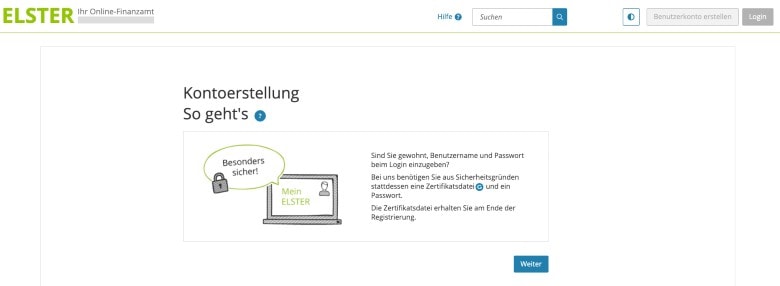

If you are a freelancer or own your own business you are most likely obliged to use ELSTER along with around 90 of businesses in Germany to submit monthly VAT returns and employee tax statements. In other words the payroll withholdings become in many cases final. As you are employed Blue Card holder you dont.

Income Tax in Germany. Determination of taxable income Kleinunternehmerregelung according to the revenue surplus calculation more than 17500 per calendar year Form ER - index to appendices Anlageverzeichnis Fixed assets computer telephone vehicle etc acquired after 05052006 must be submitted together with the cash basis accounting in. The tax return has to do with the most notable tax we pay.

Up to this amount your taxable income is not subject to tax. A Bluecard holder pays a decent amount of money as tax and contribute well to the German economy. Annual tax return - Tax declaration obligations in Germany.

If your taxable income is higher than these amounts you. Self employed individuals need to make a projection of their income for the tax year. Any amount earned above 9409 is subject to income tax.

In Germany everyones earnings are subject to a basic tax allowance. Tax structure in Germany for Employees explained. Corporate Income Tax Rate.

January 2 2024 because December 31 2023 is a Sunday 2020 income tax. How much income tax you pay. You receive a state pension.

For couples who are married or in a civil partnership the threshold is 19488 euros. The taxpayer wishes to claim a tax reduction eg for household-related employment or service contracts. Employees who are a member of a registered church Catholic Protestant etc will have to pay church tax.

This tax bill is then paid in four quarterly installments throughout the year. The application for income tax assessment is by submitting the income tax return within the four year period Deadline income tax assessment 2019. Social insurance contributions in Germany.

The first 9409 or 18818 for married couples with a joint return you earn each year in Germany is tax-free. If a taxpayer receives income above the ceiling of 274613 549226 for married couples a special tax rate of 45 the so called rich tax applies. Your salary as an employee your income from self-employment as well as for instance the.

Germany has very strong data protection regulations. In most cases the rate is 9 of the Wage Tax. You receive income from employment in Germany.

Income tax is paid by employees on a monthly basis at the source through a withholding mechanism.

Tax Return In Germany In English For Foreigners Read This Before Doing It

Income Taxation In Germany Gofrankfurttax

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Your Bullsh T Free Guide To Taxes In Germany

It Freelance In Germany Form 1 Questionnaire For The Tax Registration Https Jaroslavplotnikov Com

How To File A Tax Declaration In Germany 2021 English Guide

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

How To File A Tax Declaration In Germany 2021 English Guide

3 21 3 Individual Income Tax Returns Internal Revenue Service

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras

How To Read Japanese Tax Statement Gensen Choshu Hyo Tax Questionnaire Tq Help

3 21 3 Individual Income Tax Returns Internal Revenue Service

How To File A Tax Declaration In Germany 2021 English Guide

3 11 13 Employment Tax Returns Internal Revenue Service

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

Annual German Tax Return Einkommensteuererklarung

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Post a Comment for "Employment Tax Statement Germany"