Employee Tax Withholding Form 2019

Here are some frequently asked questions about Vermont employees withholding allowance certificates. Employees Withholding Exemption Certificate 2019.

Fillable Form 1040 Individual Income Tax Return In 2021 Income Tax Return Income Tax Tax Return

Complete a Withholding declaration form NAT 3093 if you want your payer to adjust the amount of tax withheld from payments made to you.

Employee tax withholding form 2019. If you are using Form WT4 to claim the maximum number of exemptionsto which you are entitled and your withholding exceeds your expectedincome tax liability you may use Form WT4A to minimize the overwithholding. Employees Withholding Allowance Certificate NC-4. Online through ATO online via myGov.

Form NameNonresident Taxpayer Registration Affidavit Income Tax Withholding. REV-1716 -- 2020 Filing and Remittance Due Dates - Employer W-2 and 1099 Forms. Form W-4VT was updated in January of 2019 and even employees who have recently updated their W-4s should make sure that they have completed the most recent version of the W-4VT.

Employers Withholding Tax Return. The form is part of the New Employment forms under the Employment menu. REV-1667 -- Annual Withholding Reconciliation Statement.

AR4ECSP Employees Special Withholding Exemption Certificate. Form NameRequest for Penalty Waiver. For Employers Payments for Tax Withheld.

WT-4 Instructions Provide your information in the employee section. REV-1705 R -- Tax Account Information ChangeCorrection Form. This is the total amount of taxes withheld.

1604-C filed will be considered as the substitute ITR of the employee. Form NameNonresident Shareholder or Partner Affidavit and Agreement Income Tax Withholding. The employee uses the Ohio IT 4 to determine the number of exemptions that the employee is entitled to claim so that the employer can withhold the correct amount of Ohio income tax.

The employer is required to have each employee that works in Ohio to complete this form. Currently there is no computation validation or verification of the information you enter and you are still responsible for. AR1099PT Report of Income Tax Withheld or Paid on Behalf of Nonresident Member.

Household Annual Withholding Reconciliation and Wage and Tax Statement for household employers who employ up to 10 household employees - only available electronically File Online. AR4EC Employees Withholding Exemption Certificate. Line 1-3 Enter the correct amount of Louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. REV-1706 -- BusinessAccount Cancellation Form.

AR4EXT Application for Automatic Extension of Time. REV-1601 -- Tax Credit Certification Request Form. Form NameSC Withholding Quarterly Tax Return.

Employers Withholding Tax Return. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form. Below are the instructions to file an amended Form L-1 Lines 1 - 5.

REV-1716 -- 2021 Filing and Remittance Due Dates - Employer W-2 and 1099 Forms. The IT-101A is now a combined form. Employers Withholding Tax Annual Information Return.

An individual taxpayer will no longer have to personally file his own Income Tax Return BIR Form 1700 but instead the employers Annual Information Return on Income Taxes Withheld BIR Form No. No separate reconciliation is required IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions IT-101V Employers West Virginia Income Tax Withheld. You can complete this form either.

IT-1001-A Employers Withholding Tax Tables IT-101A Employers Annual Return of Income Tax Withheld. Beginning January 1 2020 Employees Withholding Allowance Certificate Form W-4 from the Internal Revenue Service IRS will be used for federal income tax withholding only. Form K-5 is used to report withholding statement information from Forms W-2 W-2G and 1099 and is completed online with two filing methods to choose from.

Enter Personal Information a First name and middle initial. Form K-5 online filing complete and submit online Form K-5 online fill-in form complete print and mail to DOR cant exceed 25 withholding statements Form K-5. AR4MEC Military Employees Withholding Exemption Certificate.

REV-1716 -- 2019 Filing and Remittance Due Dates Employer W-2 and 1099 Forms. Form NameBatch Filing Program for Withholding Quarterly Tax Returns. Form G-4 Employee Withholding Form G4 is to be completed and submitted to your employer in order to have tax withheld from your wages.

You must file the state form Employees Withholding Allowance Certificate DE 4 to determine the appropriate California Personal Income Tax PIT withholding. 2018 Withholding Tax Forms Fillable Forms Disclaimer Many tax forms can now be completed on-line for printing and mailing. Wisconsin Department of Revenue.

Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate. Employees Withholding Exemption Certificate 2018. Line 4 Add Lines 1 2 and 3.

Your withholding is subject to review by the IRS. 2019 Withholding Tax Forms. Household Employer Annual Summary of Virginia Income Tax Withheld.

Form NameSC Withholding Tax Payment. Employers Annual Reconciliation of Wisconsin Income Tax Withheld from Wages Instructions.

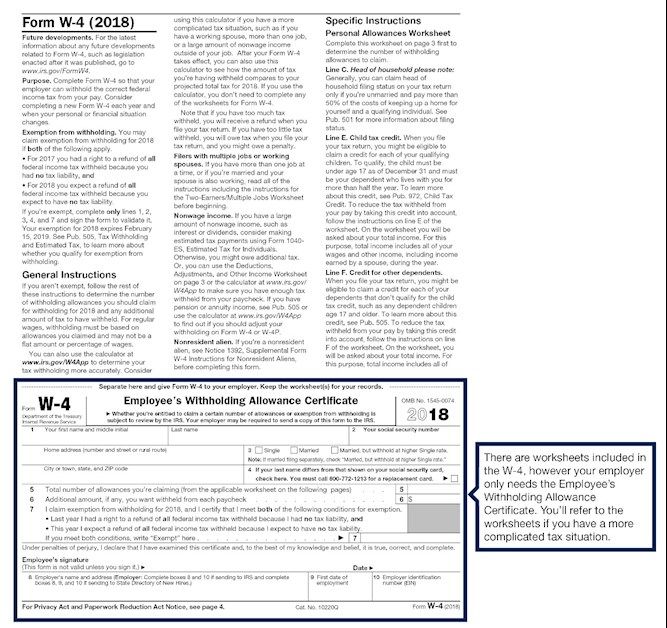

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Instruction Allowance Liberty Tax

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Irs Forms Fillable Forms 1099 Tax Form

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form How To Get Money

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications

Blank W 13 Form 13 Shocking Facts About Blank W 13 Form Employee Tax Forms Tax Forms Shocking Facts

Pin On Fillable Pdf Forms And Templates

Fillable Form 2210 In 2021 Financial Information Fillable Forms Tax Forms

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Irs Taxes Federal Income Tax Tax Refund

2015 W2 Fillable Form Fillable Form Ia W 4 Employee Withholding Allowance Fillable Forms Power Of Attorney Form 1099 Tax Form

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Pin By Bianca Kim On W 4 Form Tax Forms W4 Tax Form W2 Forms

Completed W 12 Form Example 12 Mind Blowing Reasons Why Completed W 12 Form Example Is Using Employee Tax Forms Irs Forms Form Example

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

Pin By Bianca Kim On W 4 Form Tax Forms Form W4 Tax Form

Form W 12 Example Seven Things You Most Likely Didn T Know About Form W 12 Example Tax Forms How To Get Money Need To Know

Post a Comment for "Employee Tax Withholding Form 2019"